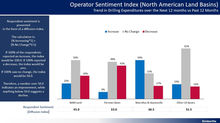

ESG Sentiment Moderating NAM Land. Remains Strong Internationally & Offshore.

- Nov 27, 2023

- 1 min read

ESG sentiment is moderating in NAM Land after having peaked nearly two years ago. ESG sentiment remains strong internationally and offshore. NAM Land ESG sentiment has declined from a high index of nearly 80 to a current level of 53, while international land and offshore both reflect sentiment strength at 91 and 88 respectively.

Operators are focusing ESG spending principally on emissions monitoring & reduction, followed by investments in CCUS. NAM Land operators are committed to operating environmentally responsibly while making economically viable investments such as upgrading compressors, reducing flaring, and implementing closed-loop systems. Deepwater operators are also heavily committed to implementing lower carbon solutions for new projects, including the integration of renewables and electrification of topside equipment.

SLB is viewed as the OFS supplier best positioned to help E&P operators achieve their ESG objectives, leading HAL and BKR by a 3/1 margin. This places SLB in an advantaged position among E&P operators who place a high value on ESG in their selection of OFS suppliers. Supplier recommendation ratings average 5% to 8% higher among operators who favor suppliers for ESG capabilities.

E&P operators will continue to invest to reduce emissions, but economics do matter and will drive innovation and technologies as the industry strives for a lower carbon future.

Kimberlite will continue to track industry trends, technology adoption and new energy investment. Feel free to reach out to discuss.

Comments