E&P Operators Expect Supplier Pricing for Hydraulic Fracturing Services to Decrease

- Aug 15, 2023

- 2 min read

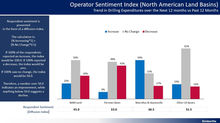

US land oil and gas operators anticipate pricing for hydraulic fracturing services to decrease by 2.9% over the next twelve months.

This follows a nearly 35% increase in average hydraulic fracturing related expenditures per well from 2021 – 2023 YTD due to higher hydraulic fracturing completion intensity (longer laterals, more stages) and price increases from the historic and unsustainable lows of 2020.

Operators continue to drive higher levels of drilling and completion efficiencies allowing the industry to accomplish “more with less”. As a result, US production is essentially on par with pre-covid levels while drilling rig count and frac crews remain lower.

Over half (52%) of US land operators anticipate hydraulic fracturing services pricing to decrease over the next twelve months while 29% of operators anticipate pricing to remain stable at current levels and 19% anticipate pricing to increase.

The softening in prices is in response to declines in rig count and frac crews in H1 2023. Certainly, timing and contract roll-off play an impact on these findings, but overall, the results of Kimberlite’s 2023 Hydraulic Fracturing Services report reveals that the service suppliers are prepared to protect margins and operators are focusing on continued efficiencies.

Currently, US land is on pace to drill the same number of wells in 2023 versus 2022, but the path to achieving these outcomes has been dramatically different with 2022 marked by the addition of 175 rigs followed by a reduction of 120 rigs YTD in 2023. While the market overall remains at a healthy level, rig count will need to increase to over 700 in 2024 to meet operators’ drilling projections.

While hydraulic fracturing prices have “rolled over”, the biggest opportunity for the industry continues to be driving efficiencies, with suppliers and operators working collaboratively to “accomplish more with less” – a trend that has been a key driver to US land success over the past several years.

Kimberlite will continue to track future pricing trends for oilfield equipment & services and report updates. Feel free to reach out to discuss.

Comments