Operators Flight to Quality Suppliers Is Expected in 2020 and 2021

- David Bat

- Sep 1, 2020

- 2 min read

With oilfield service suppliers having no room to give additional price discounts, E&P operators will turn to quality suppliers who can collaborate and proactively work with operators to identify cost out opportunities and help drive additional operational efficiency improvements.

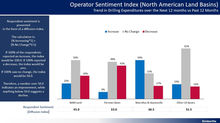

Findings from Kimberlite’s 2020 Hydraulic Fracturing report reveal that approximately 55% of US land operators expect completion cost to decline on average approximately 6.9% due to current market conditions and overcapacity of oilfield equipment.

45% of operators, however, understand that there is no additional room for oilfield service suppliers to provide any more price discounts. Rather, E&P operators will look toward new technologies such as quick-connect systems, monoline systems, equipment monitoring, data analytics, remote operation capabilities, simultaneous fracturing and other cost out options and efficiency improvement opportunities to drive improved results.

With hydraulic fracturing pricing at historic lows and no room to give additional price discounts, E&P operators will seek out top-performing suppliers. Based on feedback from 192 operators in US land and Canada, the E&P operators report a wide variance in performance among the 24 hydraulic fracturing service providers used and rated with customer reviews.

Some of the lowest performance ratings are observed with equipment quality & reliability followed by technical support as observed in the exhibit above. In addition, the wide variance in performance ratings (ranging from 6.56 to 8.70 on a 10-point rating scale) further supports that not all hydraulic fracturing service suppliers perform at the same level. It will be incumbent upon E&P operators to conduct proper due diligence to identify and seek out suppliers who are able to deliver the best value.

The performance map below for US land helps to illustrate the wide performance among the suppliers and helps to identify those suppliers who deliver the best value and performance. Supplier performance and competitive position do vary, however, by basin. For example, the market share leader, Halliburton, receives favorable customer reviews in the Permian and Bakken but receives unfavorable reviews in the Rockies and Mid-Continent.

Kimberlite will continue to track supplier performance trends by basin and E&P operator needs for 2021 and report updates. Feel free to reach out to discuss further.

Many curious homeowners ask what is a carbon monoxide detector, and UNICCM breaks it down for you in simple terms. It is a device that listens to the air for invisible danger and reacts early. UNICCM emphasizes its importance for households with fuel‑burning appliances. Early warning systems like these can prevent harm before it occurs. Knowledge protects you and your family.

The instructors at UNICCM bring a wealth of industry knowledge and real experience into the virtual classroom. Learners gain access to insights that go beyond textbook theory, learning from professionals who have worked extensively in their fields. This expert-led approach ensures academic concepts are connected to their real-world applications.

There is a big relationship between academic assignments to the learning of students. Each academic assignment comes with several requirements. For some assignments, you may need extra effort and guidance to solve them excellently. Choosing Assignment Help Canada, you can access support from subject experts who possess a higher degree and experience in writing. They can assist you in planning, scheduling, and compiling the assignment according to their requirements. By following their style and guidance, you not only prepare quality solutions for assignments but also learn the right approach to tackle complex assignments. Professional experts provide the easiest solution even on a complex topic in an assignment. This gives them clarity of topic, and they learn the way to explain the…

Celebrate the holidays like never before in the Christmas Buddy Elf Costume a must-have for fans of festive fun! With its bright colours and playful design, this outfit captures the joy and humour of the season. From cozy nights to office parties, it’s your ticket to unforgettable Christmas memories filled with laughter and magic.

I recently decided to take my online class with the support of myassignmenthelp, and it turned out to be a smooth experience. The platform connects students with skilled academic experts who handle lessons, assignments, and tests efficiently. Their tutors ensure that deadlines are met and grades improve without stress. The best part is the detailed guidance they provide throughout the process, making online learning more manageable. For anyone struggling with time management or tough subjects, using such expert-led academic support can really help maintain consistency and confidence while completing an online course successfully.