🔎 Interventions & Mature Assets: The Economic Imperative for E&P Operators

- Andrew Thornton

- Feb 4, 2025

- 1 min read

Economics matter—and the most economical well an operator can drill is the one they already have. With capital discipline and a focus on returning cash flow to shareholders, many E&P operators are shifting their focus toward interventions and mature assets as a strategic way to maintain or boost production while managing costs.

Key insights include:

Cost Efficiency: In an environment where new well expenditures are expected to be muted, operators are turning to interventions to optimize existing assets.

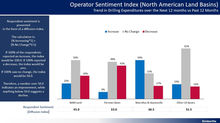

Healthy Market Outlook: According to the latest Kimberlite Intervention Study, 49% of respondents anticipate increased expenditures for interventions over the next 12 months, compared to just 25% from a recent drilling study.

Broad-Based Growth: Expectations for intervention expenditure increases outpace drilling across geographic segments and operator types.

Service Provider Advantage: Companies with greater exposure to the intervention market are poised to outperform their peers by capitalizing on this growing demand.

In today’s challenging economic climate, prioritizing interventions in mature assets not only helps

operators maintain production numbers but also ensure more efficient capital allocation.

Comments