Shifting Pricing Dynamics in Drilling Equipment and Services

- Andrew Thornton

- Jul 2, 2024

- 1 min read

The landscape for drilling equipment and services pricing is experiencing notable shifts, according to insights from the upcoming Kimberlite 2024 drilling equipment and services reports. Here’s a breakdown of what we’re seeing across the global oil and gas industry:

-International Land Market: As this market continues to expand, operators are anticipating an average pricing increase of 7%. With only 3% of respondents expecting a decrease in prices, the majority—nearly three-quarters—anticipate rising costs for drilling equipment and services.

-Offshore Activity: The offshore sector, which is witnessing the fastest growth in activity levels, shows even stronger trends towards higher pricing. Over 80% of those interviewed expect prices to rise, with an average anticipated increase of 10%.

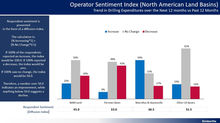

-North America Land: Despite a contraction in rig count, the pricing expectations remain relatively stable, contrasting sharply with previous downturns where a drop in activity would typically trigger demands for significant discounts. This shift indicates a new equilibrium in the North American land market, where the focus on service quality and execution is paramount. Operators are increasingly seeking partnerships with providers that offer the best technology and services, emphasizing the importance of value over price.

These trends underscore a changing dynamic in the global drilling market, reflecting broader economic factors, technological advancements, and strategic shifts within the industry. As we navigate these changes, the need for strategic partnerships and a focus on service excellence has never been more crucial.

Comments