Operator Sentiment Improving for 2017 (With additional Graphs)

- David Bat

- Mar 23, 2017

- 2 min read

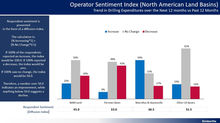

Operator sentiment for 2017 is improving based on surveys conducted by Kimberlite Oilfield Research. Kimberlite has conducted over 3,000 interviews in the past 15 months with over 300 oil and gas operators worldwide tracking operator sentiment beginning in December, 2015 and updating periodically to the current period of March, 2017. Figure 1 below shows operator sentiment is improving overall across all segments evaluated. The sentiment index is based on the operators’ expected expenditure plans for the upcoming six months versus the past 6 months.

US land was the first region to break the sentiment index of 50 reflecting planned increases in drilling and completion expenditures for the next 6 months.

Canada and international land markets have recently exhibited improvements in operator sentiment with current views reflecting operators plans to increase drilling and completion expenditures for Q2 and Q3, 2017.

Offshore operator sentiment is still below 50 reflecting that more offshore operators are expecting a decrease versus an increase in spending for drilling and completion activities for Q2 and Q3, 2017. It should be noted, however, that the sentiment index for the offshore operators is also improving and at current trends should cross over the important 50 rating within the next 6 to 9 months assuming markets remain stable with an acceptable forward oil pricing curve.

Planned drilling activity for 2017 based on well projections among the oil and gas operators surveyed support the sentiment index. Figure 2 below shows that US land operators are planning to increase drilling by 29.7% in 2017 and drilling in Canada is projected to increase 15.2% in 2017.

International markets vary by region with Latin America and Middle East reporting planned increases in drilling activity for 2017 and Asia Pacific, Africa and Europe/North Sea reporting slight decreases or no change in activity for 2017 vs 2016.

Recent communications, however, by Saudi Arabia and others placing into question the sustainability of the OPEC led production cuts has caused many operators to take notice. The operator’s ultimate plans will most certainly be influenced by Saudi Arabia’s future actions and the balancing of supply versus demand in the coming months.

Kimberlite Oilfield Research will continue to track operator sentiment and planned drilling activity and report updates.

Comments