📈 H2 2025 and Look Ahead Into 2026

- Jul 25, 2025

- 2 min read

With H2 2025 uncertainty and few looking at 2026 yet, Kimberlite's Drilling Services report, just published, provides some key insights on what we should expect ahead.

👀 Let's take a look. 👀

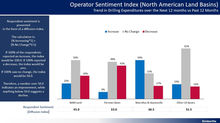

🔹 🗺️ North America Land: NAM Land remains in contraction with 30% of operators planning to decrease spending for drilling expenditures in the next 12 months, and US land operators planning to drill 5.3% fewer wells in 2026 versus 2025. Regional analysis from Kimberlite's 2025 Drilling Services report reveals gas basins such as the Haynesville and Northeast reflect expansion or an increase in drilling expenditures in the next 12 months, with 50% of operators planning to increase and only 17% planning to decrease.

Last week's Pennsylvania energy and AI summit, with over $90 billion in announced AI and energy infrastructure investments, is a vivid reminder that energy use and consumption is growing and will not plateau in the coming years as some predict.

With markets shrugging off OPEC's unwinding of spare capacity and supply uncertainties remaining around Iran, Russia, Venezuela, and other countries, do not be surprised if US land H2 2025 outperforms expectations as gas remains resilient, privates opportunistic, majors steady and consistent, and large independents re-evaluate.

🔹 🌎 International Land Market: International operators report plans to drill 1.9% more wells in 2026 vs 2025, with prices to increase 4.3% driven by demand for qualified personnel and equipment.

🔹 🌊 Offshore Activity: Offshore operators report plans to drill 0.2% fewer wells in 2026 vs 2025, reflecting stabilization following two years of decline. Similar to international prices, increases of 2.9% are anticipated, driven by demand for qualified personnel and equipment.

🔎 What do you think? Reach out if interested in a deeper dive into the 2025 Drilling Equipment and Services reports and how these trends impact your business.

Comments