Offshore Drilling Expenditures Expected to Rise

- David Bat

- Jun 9, 2017

- 2 min read

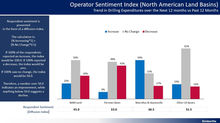

Offshore oil and gas operators report plans to increase drilling expenditures in the 2nd half of 2017. A recent study conducted by Kimberlite Oilfield Research based on interviews with 81 offshore oil and gas operators worldwide reveals that for the first time in 2 years, operator sentiment has increased above 50 to a rating of 62.5 for the Gulf of Mexico and 63.5 for international offshore markets. This indicates that the offshore market has bottomed out and that the planned future activity levels in the offshore markets will increase particularly in areas with existing fields and infrastructure. The Kimberlite report also included interviews with 191 land oil and gas operators worldwide revealing that oil and gas operating companies drilling plans for 2017 reflect a significant improvement versus that observed in 2016. US land operators plan to drill 30% more wells in 2017 versus that of 2016 and the US land rig count has doubled in the past year. US land operator sentiment trend reveals that activity in US land will plateau in the 2nd half of 2017 while operators reassess market conditions and set plans for 2018. Internationally, operators in Argentina, Boliva, Colombia, Ecuador, Egypt, Kuwait, Pakistan, Oman and the North Sea report plans to increase drilling expenditures in the 2nd half of 2017. The operator sentiment index trend is shown below and is a good reflection of how oil and gas operators’ sentiment and investment plans have improved since December, 2015.

The diffusion process used for the sentiment index is utilized in other industries and allows each operator the opportunity to respond by stating their plan to increase, decrease or no change in planned expenditures for the next six months. The resulting sentiment index is calculated by taking the percentage of operators that reported a planned future increase in expenditures and adding to that total half (50%) of the percentage of operators that reported no change in planned future expenditures. For example, a sentiment index of 50 would indicate an equal number of operators reporting “planned future increases in expenditures” and “planned future decreases in expenditures”. The index can range from 0 to 100 and ratings over 50 reflect an improvement in future planned expenditures (increase in expenditures) and ratings below 50 reflect a decline in future planned expenditures.

Comments