Halliburton Strengthens Position in North America Land

- Jan 25, 2018

- 3 min read

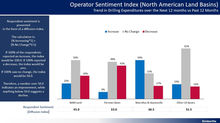

Halliburton demonstrates market leadership in North America land. Halliburton’s leadership is observed by their increased customer loyalty ratings as measured by the Net Promoter Score, improved supplier performance versus that of their key competitors and Halliburton’s increase in North America land market share. Halliburton’s ability to improve performance and increase prices results in higher profits as observed in their Q4 2017 earnings report.

By contrast, however, Schlumberger’s declining performance in North America land is observed by their declining customer loyalty ratings as measured by the Net Promoter Score, declining supplier performance versus that of their key competitors and declining market share. Schlumberger is struggling to differentiate their technology and performance and to defend the pricing premium they seek in the North America land market.

These and other observations are based on interviews with 2,188 respondents and over 65,000 customer ratings and provide objective and accurate assessments of how the big 4 oilfield service suppliers performance in North America land compare for 2016 versus 2017.

Baker Hughes GE performance in North America land is drifting lower as observed by their declining customer loyalty ratings as measured by the Net Promoter Score, declining supplier performance as compared to their key competitors and declining market share. This results in Baker Hughes GE having to use lower pricing versus that of Halliburton and Schlumberger to help offset their performance shortcomings and negatively impacts profitability.

Weatherford, on the other hand, exhibits improved customer loyalty ratings as measured by the Net Promoter Score and improved supplier performance as compared to the big 3 suppliers. However, Weatherford continues to undervalue their offerings in the market hindering their transformation efforts and ability to improve their financials.

The comprehensive Kimberlite database allows for supplier performance trends 2016 versus 2017 for key performance measures such as the Net Promoter Score and supplier performance on six factors (equipment quality, technical support, competency of field service personnel, responsiveness, availability/delivery and operational advantages including time & cost saving benefits).

The exhibit below highlights the performance trends of the big 4 oilfield service suppliers for 2016 versus 2017 as well as provides their pricing competitiveness trends versus the market average.

Kimberlite recently reported the observation that the correlation of the Net Promoter Score and oilfield service supplier financial performance is not a perfect 100% correlation, but that it is reasonable to assume that as a company’s customer loyalty rating increases, the likelihood to increase business and improve financial performance also increases. Conversely, as a company’s customer loyalty rating decreases, it is reasonable to assume that business performance will also decrease as long as the customers have viable options to switch suppliers and are not locked into long term contracts.

The data above demonstrates a correlation between the big 4 oilfield service supplier’s Net Promoter Score and their overall performance as measured on six different factors for the North America land market.

In addition, Kimberlite recently reported the correlation between Halliburton and Schlumberger’s worldwide Net Promoter Score and revenue trends for the trailing twelve months (TTM). The exhibit below illustrates that Halliburton’s worldwide customer loyalty ratings as measured by the Net Promoter Score have increased in the trailing twelve months (TTM) by approximately 33.6% and Halliburton’s revenues have also increased by approximately 35.69% during the same period.

Schlumberger’s worldwide customer loyalty ratings as measured by the Net Promoter Score have increased in the trailing twelve months (TTM) by approximately 17.01% and Schlumberger’s revenues have also increased by approximately 11.23% during the same period.

Given the need and desire to establish a forward-looking measure of company financial performance, it is recommended that tracking the Net Promoter Scores of the suppliers be employed to assist in the evaluation and forward modeling.

Comments