Deepwater Expenditures to Increase 11.7% Per Year 2019 - 2021

- David Bat

- Jul 18, 2018

- 2 min read

Subsea oil & gas operators worldwide report plans to increase subsea development expenditures by 11.7% per year 2019 – 2021. Gulf of Mexico operators report plans to increase subsea development expenditures by 14.2% per year and international subsea operators report plans to increase expenditures by 9.5% per year.

Kimberlite Oilfield Research recently published the 2018 Subsea Equipment and Services report based on interviews with 102 subsea engineers and managers representing 46 unique operating companies managing a total of 4,563 subsea wells worldwide.

The updated forecast reveals that subsea oil & gas operators are generally optimistic overall about the future and are willing to increase investment in subsea development projects.

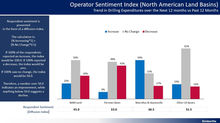

Kimberlite Research also tracks the broader drilling and completion expenditure trends for the deepwater oil & gas segment. The deepwater sentiment index improved in late 2017 (rising above the critical index rating of 50.0) and the improved operator sentiment is also validated in the Subsea Equipment & Services report published in June, 2018 with an overall worldwide sentiment index of 66.5.

The exhibit below highlights the trend in deepwater drilling and completion expenditures over the next 12 months and provides the operator sentiment index trend going back to 2016 as a point of reference.

This analysis is based on interviews with deepwater operators worldwide by Kimberlite Oilfield Research and the resulting sentiment index rating of 66.5 as shown in the table above reflects the improved sentiment of the deepwater operators who are increasing their spending plans in the deepwater worldwide.

The diffusion process used for the sentiment index is utilized in other industries and allows each operator the opportunity to respond by stating their plan to increase, decrease or expect no change in planned expenditures for the next 12 months. The resulting sentiment index is calculated by adding the percentage of operators reporting a planned future increase in expenditures to half (50%) of the percentage of operators that reported no change in planned future expenditures. Operators with plans to decrease spending are excluded from the calculation.

The index can range from 0 to 100 and ratings over 50 reflect an improvement in future planned expenditures (increase in expenditures) and ratings below 50 reflect a decline in future planned expenditures.

Deepwater operators typically require a minimum of 12 months of oil price stability before they are willing to seriously consider increases in expenditures for future long-term plans and commitments. 2017 brought a year of oil price stability and deepwater operators are beginning to reassess their 5-year forward plans with increased expenditure commitments.

While many unknowns exist in the market with respect to the geopolitical stability of the Middle East and many other producing regions, the current sentiment among deepwater operators remains cautiously optimistic with many current near-term investment plans focused on exploitation of opportunities within existing fields and also with infrastructure led initiatives whereby existing assets are leveraged with long tiebacks in an effort to reduce costs.

Good rreading this post