Oil Price War Re-Visited

- Mar 10, 2020

- 1 min read

Last time Saudi Arabia engaged in an oil price war, starting in November 2014, the impact on the oil & gas industry was felt for several years. It seems reasonable to re-visit the past in order to apply what we have learned to the current oil price war that started on Friday, March 6th.

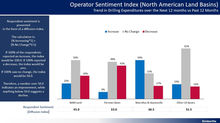

As noted in the exhibit below, oil prices declined in the 2015 oil price war and reached a low of $26 per barrel in February 2016. US land oil drilling rig count also declined and reached a low of approximately 320 in May 2016. The number of wells drilled in US land dipped below 10,000 in 2016 before improving in 2017. In short, the oil price war of 2015 resulted in US land activity declining for a full two years (2015 and 2016).

$50 per barrel remains the critical break-even price point for many US land operators and any sustained oil price point below $50 will ultimately result in declining activity and production levels.

However, in the 2015 oil price war, the US land operators and oilfield service suppliers focused on innovation to develop more efficient ways of drilling and completing wells, resulting in the US being able to ultimately produce more oil and gas with fewer drilling rigs and hydraulic fracturing spreads.

While oil price wars are not desired and create significant negative shocks to the market, the necessity to survive most often results in driving new innovation and elevating efficiency levels.

Comments