Subsea Market Poised for Multi-Year Investment Growth Cycle

- David Bat

- Jun 2, 2022

- 2 min read

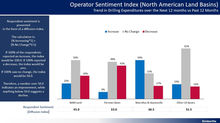

Subsea oil & gas operators plan to increase expenditures for subsea development over the next three years by 13.2% per year on average due to the recent increase in oil prices. This reflects a significant improvement versus the decline observed in 2020 and 2021 in response to the covid pandemic and associated demand destruction. The past seven years of underinvestment in the oil & gas industry coupled with covid induced supply shock and growing demand post covid has set the stage for what is expected to be a multi-year growth cycle for the deep-water segment.

The Gulf of Mexico will lead the market with projected expenditure increases of 14.9% per year while international operators report plans to increase subsea development expenditures by 12.0% per year for the next three years.

These updated findings are from Kimberlite Oilfield Research who recently published the 2022 Subsea Equipment report based on interviews with 104 subsea oil and gas customers responsible for operating in aggregate 4,826 subsea wells worldwide.

With the call for shorter cycle barrels to come to market, brownfield expansion and production enhancement investments collectively outpace new project development by a 60 to 40 ratio. Operators are focusing on exploiting opportunities within existing fields and adjacent acreage with infrastructure-led initiatives whereby they leverage existing assets with long tiebacks to reduce costs and speed up barrels to the market.

Brownfield projects are shorter cycles and require responsive supply chains that can deliver in 12 months or less. This will require subsea suppliers to maintain stocking programs for subsea trees to accommodate these projects or operators may face delays in project implementation. Currently, subsea tree deliveries are averaging 18.2 months and are expected to increase further with many operators reporting 24 months or longer to take delivery of a new subsea tree.

While integrated EPCI and existing frame agreements play a substantial role in the selection of subsea completion systems, suppliers who can provide quick delivery and availability are best positioned to gain incremental business and establish new relationships with operators who are seeking to implement short-cycle projects in an environment with constrained supply chains.

In addition, deepwater barrels are some of the lowest carbon barrels produced in the world, and operators are planning to leverage offshore wind projects to power the developments along with increased use of all-electric systems to further improve the carbon impact.

Kimberlite will continue to track the future expenditure plans among the deep-water operators worldwide and report updates on technology adoption and operational trends. Feel free to reach out to discuss

Comments