Use of Dissolvable Plugs Continues to Increase

- David Bat

- May 5, 2020

- 2 min read

Oil & gas operators worldwide report increasing use of dissolvable plugs.

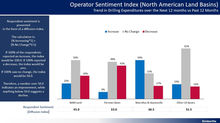

North American land operators report the highest use of dissolvable plugs. Dissolvable plug use in North America land comprises approximately 17% of plug usage in 2020 and this reflects a strong increase from only 3% in 2016 and 10% in 2018. 36% of North American land operators plan to increase the use of dissolvable plugs over the next two years.

The drilling of longer lateral wells in North America's land has contributed to the increased use of dissolvable plugs to assist with hydraulic fracturing completion operations in the toe of the well.

International operators report the lowest use of dissolvable plugs. Dissolvable plug use among international operators has grown very slowing in recent years and comprise only approximately 5% of plug usage in 2020 (up marginally from 4% in 2018).

In 2019, the dissolvable plug market grew to over $271 million in total market size. While the size of the market for dissolvable plugs will decline in 2020 due to contraction in completion activity, the use of dissolvable plugs as a percentage of plug usage is expected to continue to grow in 2020.

These findings are based on interviews with 250 oil & gas operators worldwide conducted by Kimberlite Research in Q1, 2020, and published in Kimberlite’s 2020 Conventional and Dissolvable Plug report.

The ultimate future use and adoption of dissolvable plugs will also be dependent upon suppliers continuing to improve the rate and consistency of dissolvability which continues to be the #1 concern among users. Consequently, customer loyalty ratings as measured by the Net Promoter Score are 5 times higher for conventional/composite plugs versus that of dissolvable plugs.

Kimberlite will continue to track and monitor the use and adoption of dissolvable plugs in 2020 and subsequent years. Please reach out to discuss if you need additional information.

Comments